Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOJK crashes the fintech party, but it may be for the better

New fintech companies are given a year to pilot their innovation and receive assessments before they are permitted to fully operate on a larger scale.

Change text size

Gift Premium Articles

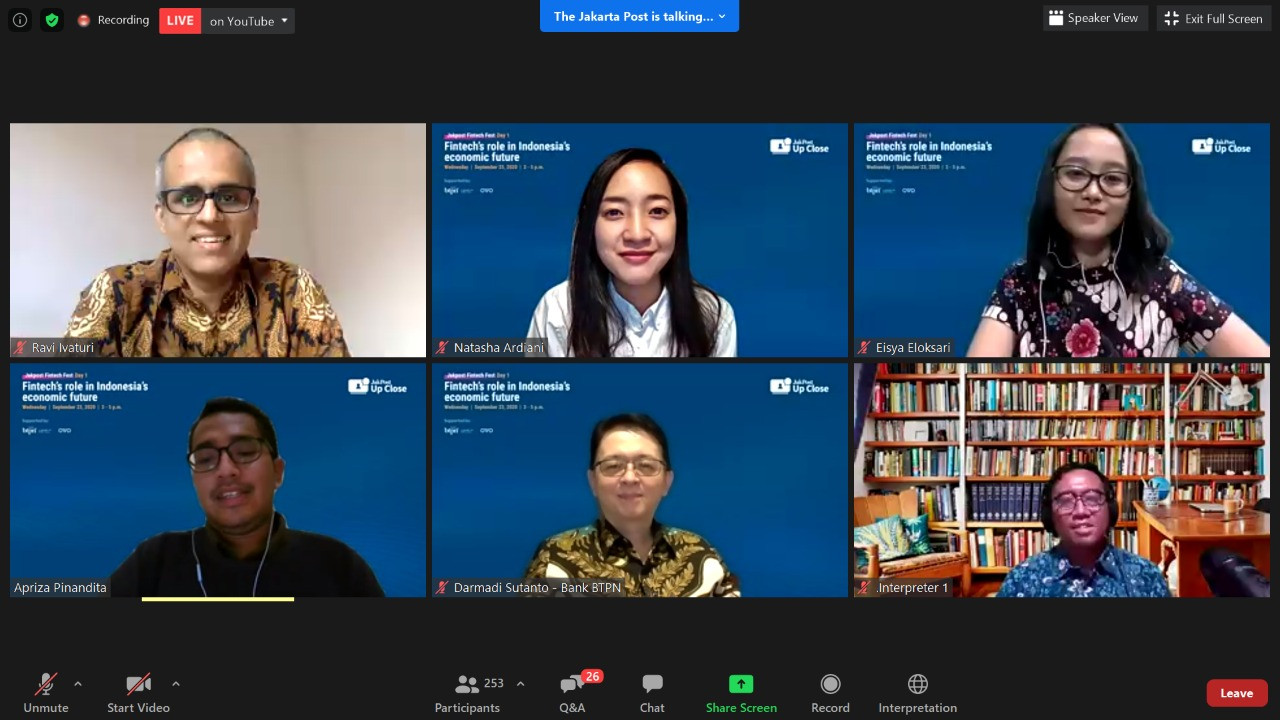

to Anyone

PwC Indonesia advisor Ravi Ivaturi (upper left), OVO vice president of lending services Natasha Ardiani, 'The Jakarta Post' journalist Eisya A. Eloksari, interpreter Hikmat Gumilar, Bank BTPN deputy president director Darmadi Sutanto and the 'Post' journalist Apriza Pinandita (lower right) pose for a picture after Jakpost Fintech Fest online discussion on Sept. 23, 2020, with the theme of Fintech's role in Indonesia's economic future. (JP/-)

PwC Indonesia advisor Ravi Ivaturi (upper left), OVO vice president of lending services Natasha Ardiani, 'The Jakarta Post' journalist Eisya A. Eloksari, interpreter Hikmat Gumilar, Bank BTPN deputy president director Darmadi Sutanto and the 'Post' journalist Apriza Pinandita (lower right) pose for a picture after Jakpost Fintech Fest online discussion on Sept. 23, 2020, with the theme of Fintech's role in Indonesia's economic future. (JP/-)

The Indonesian Financial Services Authority (OJK) has finally overhauled the financial technology (fintech) sector by issuing OJK Regulation 10/2022 on Information Technology-Based Collective Financing Services. Extended obligations for technology-powered financial-service providers signal that the country is gradually moving away from an entity-based approach to an activity-based approach in regulating the sector.

The move poses both benefits and risks for the sector in the country moving forward.

The growth of fintech in Indonesia has been nothing short of remarkable. Fintech lending, for example, has managed to disburse more than Rp 40 trillion (US$2.6 billion) as of May. This is almost 700-percent growth from the 2018 figure.

As around 70 percent of the borrowers were also from the “credit invincible” population, the fintech party also helped accelerate financial inclusion in the country -- currently sitting at 76 percent as per OJK’s latest national survey.

The success of the fintech sector is partly owing to the regulatory approach that Bank Indonesia (BI) and OJK adopted in the past. Fintech companies, especially providers of tech-enabled loans, are excluded from some of the requirements imposed on nondigital players engaging in a similar activity (e.g., banks or financing companies). In short, they are being managed based on the nature of their business model that relies on digital technology and requires room for continuous innovation (entity-based) instead of the activity that they are engaging in (activity-based).

One of the prime examples of special treatment is the application of regulatory sandbox for newcomers, where they are given a year to pilot their innovation and receive assessments before they are permitted to fully operate on a larger scale. Other examples include a relatively low paid-up capital of Rp 2.5 billion (US$168,000) compared to multi-finance companies or banks that engage in similar activities.