Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsInfrastructure, tech, healthcare deemed ripe for takeovers

M&A transactions typically flourish when the capital market is stable, according to a top banker of JP Morgan in Indonesia.

Change text size

Gift Premium Articles

to Anyone

I

nvestment banks are gearing up for increased merger and acquisition (M&A) activity in Indonesia this year after capital market volatility prompted a slowdown in 2022, with companies in the infrastructure, technology and healthcare sectors seen as prime targets.

According to Gioshia Ralie, senior Indonesia country officer at JP Morgan, M&A transactions will go along with the capital market, which is the combination of stocks, bonds, foreign currencies and other assets market.

"If the market is stable and less volatile, M&As could work. [On the other hand], if the capital market is not good, private deals might be more interesting," Gioshia said at a media roundtable in Jakarta on March 1.

Volatility in the capital markets had limited the number of M&A deals last year, he explained, adding the United States-based investment bank was starting to see transactions in the sectors of infrastructure, metals and mining, financial services and logistics as well as in technology, media and telecom (TMT) this year.

"There are around five to six ‘sizeable’ M&A transactions in those sectors that have started to [emerge], while we are hoping for greater stability in the future," Gioshia explained.

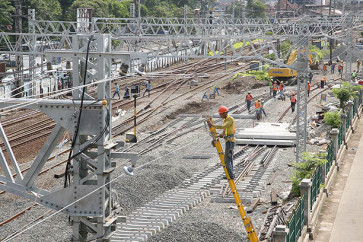

Former Finance Minister Bambang Brodjonegoro said he also saw M&A potential in infrastructure-related sectors as the country kept pushing for physical construction work to be carried out.

"The capacity of the government [is not enough], so we're talking about M&As that may involve state-owned enterprises (SOEs) or some projects under their wings," the economist said in an online briefing on Thursday.