Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAnalysis: Mitratel solidifies top market share position by crossing competitor lines

PT Dayamitra Telekomunikasi or Mitratel (MTEL) further cements its position as the biggest tower solutions provider in Indonesia as it finalizes a deal with Indosat Ooredoo Hutshison (ISAT).

Change text size

Gift Premium Articles

to Anyone

Two officers perform maintenance of telecommunications towers at PT Tower Bersama Infrastructure, Tbk (TBIG) in the Cikampek area - West Java, Friday (02/08). Specifically in the TBIG homecoming route, TBIG operates 368 sites, while in the southern homecoming route TBIG operates 457 sites. TBIG prepares a team that is ready 24 hours 7 days for possible risks. (JP/Nurhayati)

Two officers perform maintenance of telecommunications towers at PT Tower Bersama Infrastructure, Tbk (TBIG) in the Cikampek area - West Java, Friday (02/08). Specifically in the TBIG homecoming route, TBIG operates 368 sites, while in the southern homecoming route TBIG operates 457 sites. TBIG prepares a team that is ready 24 hours 7 days for possible risks. (JP/Nurhayati)

P

T Dayamitra Telekomunikasi or Mitratel (MTEL) further cements its position as the biggest tower solutions provider in Indonesia as it finalizes a deal with Indosat Ooredoo Hutshison (ISAT) to purchase 997 of their towers to add to the 34,800 towers they owned as per September 2022. Prior to this deal, most of their towers were acquired from Telkomsel, a sister company to Mitratel and competitor to ISAT.

Much like their agreements last year with Telkomsel, the deal between Mitratel and Indosat uses a “sales and lease back” scheme. Mitratel will pay ISAT Rp 1.64 trillion (US$109 million) for the 997 towers and lease 983 of them back to ISAT for the upcoming 10 years at a price of Rp 138.6 billion a year.

One of the main benefits of transferring ownership of a tower to a solutions provider like Mitratel, is that a single tower can be leased to multiple different operators, even if they were competitors. However, the tenancy ratios of Mitratel’s towers are still behind their tower solutions peers. While the average tenancy ratio of other tower owners is around 1.87x, the tenancy ratio for Mitratel towers is still around 1.44x.

On the other hand, to differentiate itself from its peers, Mitratel has been expanding its business to include infrastructure assets other than towers. Just November last year, Mitratel signed a cooperation agreement with PT Telkom Satelit Indonesia (Telkomsat) to provide satellite backhaul services. This cooperation adds satellite connections to their network portfolio, allowing them to provide solutions to operators struggling with geographical constraints where tower connections and cable coverage is limited.

Another part of Mitratel’s asset portfolio also includes fiber optic cables, which have a total of over 15,000 kilometers in length connected to towers by the end of 2022. Fiber optics and edge computing, another part of Mitratel’s asset portfolio, will become important infrastructure when the market shifts towards 5G in the future. However, the coverage of 5G in Indonesia is still limited to urbanized regions and projects to increase their coverage are still underway.

For now, Mitratel President Director Theodorus “Teddy” Ardi Hartoko will be focusing on boosting tenancy ratios. The company’s performance last year showed that tower leasing produces desirable results, where the earnings before interest, taxes, depreciation and amortization (EBITDA) margin for the tower leasing segment was at a high 85.2 percent. Should their asset monetization strategies perform well, Teddy believes that Mitratel could potentially become one of the top 10 market capitalized companies in Indonesia this year.

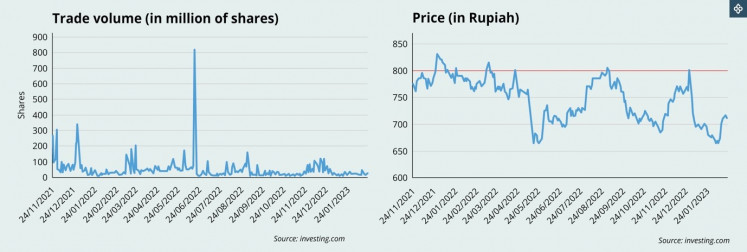

The stock market has also been reacting to Mitratel’s deal with Indosat. On Feb. 14 and 15, the day before and during the signing of the deal between Mitratel and Indosat, the trading volume of Mitratel’s MTEL shares spiked. The corporate action is seen by some investors as a signal that foreshadows growth in MTEL’s performance.

On the other hand, the market’s reaction can also be considered relatively cautious overall. In contrast to the spike when MTEL was listed in the London FTSE index on June 2022, the price and trade increases of MTEL shares in 2023 have been slow but steady. Like many other tech companies, MTEL share prices reached their peak not long after their IPO in November 2021 and they have struggled to stay around their IPO price of Rp 800 per share.

What’s more

Some market analysts have predicted that the demand for digital solutions will shift towards integrated infrastructure, to accommodate the demand for smooth 4G and 5G connections. This would be poised to benefit Mitratel, who already has a strong fiber optics portfolio along with their cooperation with Telkomsat, who have landing rights from SpaceX satellites to provide a backbone to regions that lack fiber optic cable coverage.

Mitratel could potentially grow their revenue to Rp 5.6 trillion in 2023, which is a 9.8 percent Year-on-Year (YoY) growth compared to 2022. In accordance with that, their net profits could also reach Rp 1.9 trillion, which is a 7.7 percent YoY growth. As a basis for comparison, Mitratel recorded a revenue of Rp 5.6 trillion for the first nine months of 2022, which was a 11.5 percent YoY increase. Whereas their net profit reached Rp 1.23 trillion for that same period, which was an 18.1 percent YoY growth.6

Many of the contracts Mitratel has signed with their lessees tend to be stable due to their long-term nature. This means that if interest rates begin to fall in 2023, as they have been projected to, investors into MTEL stock could stand to profit.

What we’ve heard

A source at Indosat Ooredoo Hutchinson (ISAT) said the company's move to sell the towers was triggered by efficiency considerations. With this sale, the company will receive a cash inflow that can be allocated to support ISAT's strategic steps going forward.

The source added that it was cheaper for ISAT to lease the towers than to own them. The company has to pay more operational expenses for maintenance on the towers it owns, alongside staffing costs. That was why ISAT pushed for the “sale and lease back” deal of the towers it sold to Mitratel and dhost.

“If we were to manage the towers ourselves, we wouldn’t be able to lease them to other telecommunications operators,” added the internal source.

“So if it was managed by a third party, it would be more efficient because a single tower can be leased by several other operators,” he said

Meanwhile for Mitratel, their core business is to provide and lease towers. The addition of more tower assets from this acquisition gives them more ammo to deal with competition against PT Sarana Menara Nusantara, owned by Djarum Group, and Tower Bersama Infrastructure, which is affiliated with Saratoga Group.

Until two years ago, Sarana Menara Nusantara was the number one player in the industry, both in terms of total towers owned and the tenancy ratio. Now Sarana Menara Nusantara’s position is increasingly threatened by Mitrael’s penetration.

A source and the telecommunications company said Mitratel’s plan to acquire the towers owned by operators was part of the agenda they had prepared not long after their IPO.

“It was since the acquisition of the 8,000 or so towers from Telkomsel,” he said.

Mitratel’s cooperation with IOH has slightly shifted the competitive landscape in the tower provider industry because previously Indosat Ooredoo (before its merger with Hutchinson 3) worked more closely with Sarana Menara Nusantara.

Disclaimer

This content is provided by Tenggara Strategics in collaboration with The Jakarta Post to serve the latest comprehensive and reliable analysis on Indonesia’s political and business landscape. Access our latest edition to read the articles listed below:

Politics

- Court showcases, justice collaboration pays

- PSSI finds new strength under popular VP candidate Erick Thohir

- House wants power to assess Constitutional Court justices

- Expansion of territorial command puts TNI reforms at stake

Business and Economy

- RI launches JETP secretariat to accelerate energy transition

- Lippo Cikarang stock price in free fall amid Meikarta fiasco

- Perry Warjiyo to remain BI governor to give unwavering support to govt