Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAnalysis: Digital rupiah to pressure electric money and digital wallet dominance

Ever since Bank Indonesia (BI) announced their intent to to create a central bank digital currency (CBDC) in July, everyone voiced concern regarding the risk of the monetary authority becoming a competitor to digital wallet services.

Change text size

Gift Premium Articles

to Anyone

E

ver since Bank Indonesia (BI) announced their intent to to create a central bank digital currency (CBDC) in July, everyone voiced concern regarding the risk of the monetary authority becoming a competitor to digital wallet services. Last week, the central bank finally published their white paper on how they will be implementing the new digital rupiah, as well as addressing concerns from businesses and consumers.

In the white paper, BI says that they will be operating with a “do no harm” principle, which means that they don’t want to interfere with the current electric money ecosystem. To achieve this, they will be creating two categories of the digital rupiah, wholesale digital (w-Digital) and retail digital (r-Digital) rupiah. The plan is that consumers can only access r-Digital rupiah, however r-Digital need to be converted from w-Digital, which BI is only able to issue to approved financial institutions. This segmented system is meant to mimic conventional monetary systems and thus minimize the impact of the digital rupiah’s introduction.

However, the CBDC white paper still hasn’t addressed the elephant in the room. Ultimately, the digital rupiah is still introducing a new system of payment into the market. Electric money that is currently already circulating in the through services such as GoPay, OVO and Link Aja would be excluded from being digital rupiah, because r-Digital rupiah has to be converted from w-Digital.

As is, there is already a level of difficulty for consumers to convert money in digital wallets into cash, and the digital rupiah would only add another obstacle. Although the digital literacy rate of Indonesia is high, the financial literacy of Indonesians are comparatively still lacking. High rates of financial inclusion can be found in big cities, but small cities and countryside still commonly transact with cash.

BI governor Perry Warjiyo argues that the benefits of digital rupiah implementation will outweigh the difficulties of its implementation. Firstly, the digital rupiah’s integration with BI FAST and QRIS infrastructure will effectively reduce the cost of transaction to zero. Secondly, digital rupiah is interconnected with web3, which allows for easy purchase of digital assets such as metaverse or certain cryptocurrencies. Finally, the distributed ledger technology (DLT) utilized by the CBDC guarantees absolute security in transactions.

On the other hand, the benefits of digital rupiah can also be seen as disadvantageous to the current financial environment. The 0 transfer cost means that banks would be losing their revenue that would normally be collected from transfer fees. Similarly, the integration with web3 means that the purchase of digital metaverse or crypto assets would no longer incur any conversion costs for the service providers. However, one of the most worrisome issues is in relation to exactly how the digital rupiah would be guaranteeing financial security.

The issuance of w-Digital and conversion to r-Digital rupiah using DLT means that there a ledger of all transactions will be recorded through every device connected to the network. This means that BI will have a record of any digital rupiah transaction with no exception. On the one hand, this has the benefit of easily catching money laundering schemes or the funding of illegal acts such as terrorism. But on the other hand, this is an extreme breach of privacy for both the consumers and the financial intermediaries who transfer or convert digital rupiah. Aside from discovering illegal undisclosed funds, this new ledger could be used to reveal vital business trade secrets that would normally be legally excluded from financial statements.

What’s more

BI acknowledges the perks of using electronic money, however they also argue that extremely high adoption rates can potentially disrupt the transmission of monetary policies. This instance was seen for a short period in China, where services like Alipay and WeChat Pay became big enough that they were beyond the reach of monetary control.

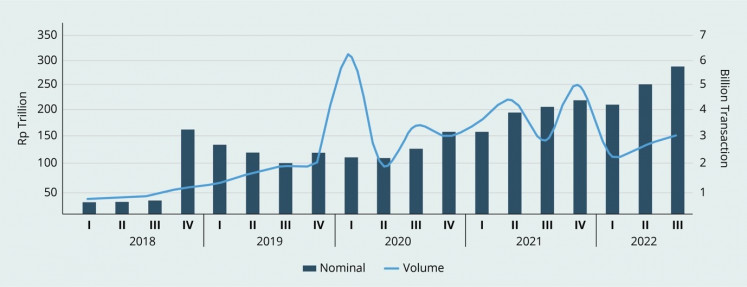

The decision to publish CBDC is related to the high rates of electric money adoption in Indonesia following the COVID-19 pandemic. Because of this, BI has to introduce an instrument that would reinstate the sovereignty of monetary policy in the digital age. This is where the digital rupiah comes in.

The first phase of CBDC introduction will strictly encompass the issuance of w-Digital Rupiah. Depending on how this first phase develops, the BI will adjust their plans on how the digital rupiah will be used as an instrument for monetary policy in their second phase. The third and final phase is where BI will authorize the conversion of w-Digital into r-Digital rupiah in limited tests.

Quarterly electronic money transactions in Indonesia

Source: bi.go.id

What we’ve heard

Several sources in the government said that Bank Indonesia was faced with a dilemma as it developed the digital rupiah. On the one hand, the central bank did not want to lose momentum with developing its digital-based payment systems through the presence of its digital currency. This is also in line with the central bank's mission of becoming the main controller of the payment system in Indonesia.

On the other hand, Bank Indonesia is aware that developing the digital rupiah is not easy – especially regarding aspects of data security and low financial literacy in society, not to mention the uneven internet infrastructure, which means that public access to digital payments can only be implemented in big cities.

An internal source at the central bank said another challenge came from the banking industry itself. It did not want the digital payment system and payment transaction services to be fully controlled by the central bank. Players in the banking industry are also suspected of trying to undermine the creation of a central bank digital currency (CBDC). They are worried that the CBDC would reduce commercial banking business, which has so far received abundant fee-based income from transaction services. This is especially the case for large banks that have strong payment system infrastructure with an extensive network. Supported by technology, their presence undermines the role of the central bank.

Up to this point, large banks have had the luxury of being able to pay low interest rates to their depositors. By taking advantage of bank infrastructure, customers are pampered with the convenience of doing business, from paying for business transactions and payroll systems to remittances. "Banks like this will lose business and fee-based income if there is a reliable CBDC," said the source. The presence of CBDCs could force banks to return to the most basic banking business, namely providing credit and accepting deposits. The source added that the presence of a CBDC could also reduce the dominance of a handful of banks or start-up companies that control payment systems within a country.

Another concern is that with the implementation of Indonesia’s CBDC, money ownership would become more transparent, and nothing could be hidden anymore. For people who do not want the origin of their wealth to be known, the CBDC could be a problem. "Fraudulent businessmen and black conglomerates, they don't want their undisclosed wealth to be found out," said the source. Because the origin and amount of assets would have implications for paying taxes that must be transferred to the state.

Disclaimer

This content is provided by Tenggara Strategics in collaboration with The Jakarta Post to serve the latest comprehensive and reliable analysis on Indonesia’s political and business landscape. Access our latest edition to read the articles listed below:

Politics

- How powerful is Jokowi in deciding the 2024 outcome?

- ‘Star wars’ reveal entrenched corruption within police

- IKN law to be revised to keep hopes for new capital alive

- KIB moves closer to considering external candidates for 2024

Business and Economy

- Dwi Soetjipto reappointed SKK Migas chair amid dwindling oil output

- GoTo aims for global listing in first half of 2023

- Jitters around oil price rises as G7 and Australia cap price of Russian oil